As a result of the offer, a different regulatory disclosure regime kicks in, which means that we can see all sorts of detail on which investors are doing what. And, as you might expect, we can already see some hedge funds piling in with fairly sizeable positions.

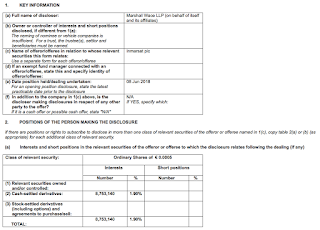

For example, Marshall Wace:

And Pelham:

As you can see from the disclosures, the long positions these funds have taken have been built up using derivatives rather than by buying shares. This shouldn't be any surprise to anyone who followed the detail of the GKN/Melrose bid. And obviously this will be a bloc of investors that will want Inmarsat to be taken over.

It also means that we should expect to see banks emerge as major shareholders on the Inmarsat shareholder register as they build up holdings as counterparts to these derivative positions. Plus we will probably see a notable short position in Echostar emerge.

Finally, here is a quick look at who the major shareholders (1%+) at the moment, data from Capital IQ.

UPDATE: for completeness it's worth noting that a few investors are actually short Inmarsat. So worth keeping an eye on this too. Latest from FCA disclosure below.

No comments:

Post a Comment