If you've spent any time trying to get pension funds to take account of labour issues, or any other social or environmental issue for that matter, at some stage you will have been on the receiving end of the need not to politicise investment decisions. Returns are paramount, and to focus on anything else would be a breach of fiduciary duty, absolutely not in beneficiaries' interests.

What then are we to make of the recent Court of Appeal decision that on the face of it upholds the Government's madcap scheme to require the Local Government Pension Scheme to invest in line with UK foreign policy? This is about as explicit as you can get in terms of political interference in investment decision-making.

The background to this is an attempt by the government to stop schemes from disinvesting from assets linked to Israel. Whatever your views on Palestine, this should trouble you. First, even if you agreed with the politics behind it (which I don't) it would be a planet-sized sledgehammer to crack a nut. There are very few schemes that have even considered disinvestment.

Second, as anyone who has looked at fiduciary duty will tell you, actually schemes are suppose to have quite a lot of freedom of movement provided that they approach their decisions in the right way. This intervention essentially goes in the other direction in seeking to instruct pension funds what decisions they should reach. What if investments linked to Israel, or any other country that we favour in foreign policy, perform badly? The government's approach seems to stray into taking certain decisions without considering beneficiary interest. I cannot see that surviving another well-argued legal challenge.

There's a slightly made element to it too. Assuming the current government wins the argument, what happens if it loses an election to a Corbyn-led government with a different policy in relation to Israel, including support for boycotts? What would investing in line with foreign policy look like then?

The whole idea deserves to be challenged, as I am sure it will be again.

Saturday, 30 June 2018

Wednesday, 27 June 2018

Chantal Mouffe again

I don't agree with everything she says, but a lot of it is on the money:

Every order is the temporary and precarious articulation of contingent practices. The frontier between the social and the political is essentially unstable and requires constant displacements and renegotiations between social agents. Things could always be otherwise and therefore every order is predicated on the exclusion of other possibilities. It is in that sense that it can be called 'political' since it is the expression of a particular structure of power relations. Power is constitutive of the social because the social could not exist without the social relations which give it shape. What is at a given moment considered as the 'natural' order - jointly with the 'common sense' which accompanies it - is the result of sedimented practices; it is never the manifestation of a deeper objectivity exterior to the practices that bring it into being.

.......

Contrary to the various liberal models, the agonistic approach that I am advocating acknowledges that society is always politically instituted and never forgets that the terrain in which hegemonic interventions take place is always the outcome of previous hegemonic practices and that it is never a neutral one. This is why it denies the possibility of a non-adversarial democratic politics and criticises those who, by ignoring the dimension of 'the political', reduce politics to a set of supposedly technical moves and neutral procedures.

Tuesday, 26 June 2018

A defence of capital strategies as a tactic for unions

There have been a few bits and pieces recently that I have read that critique capital strategies from a labour movement perspective. I think these are generally helpful, and having worked in this field for a long time, I share some of the critical views expressed.

Nonetheless at points I think some critics end up articulating a position of "radical inaction" - essentially that it is better not to get involved with pension funds, and we should so other things. I think this would be a mistake, so here are a few points I would make in return.

1. Most obviously, we do not have to choose between organising and capital strategies and other campaigning tactics. Some critics of capital strategies work appear to believe that this is seen as a shortcut to/substitution for organising. I can only speak from my own experience, but most capital strategy work I have been involved in has developed where a) there is a live organising drive and b) where the union(s) at the sharp edge want to engage investors.

This work has to be linked to organising to have any value. In my experience, in practice capital strategies get used where there is live organising and the company responds in a hostile fashion.

2. Almost as obviously, someone will employ capital strategies utilising workers' retirement savings, even if unions don't. Most frequently, our pension funds delegate control to asset managers who will then utilise the power that different corporate law/governance regimes give them to pursue what to them seem to be reasonable objectives. In plenty of companies I've been involved with - Ryanair, Sports Direct etc - there was already some degree of investor interaction with the companies underway before unions got involved.

The default / status quo in terms of use of our capital in shareholder/investor-company relationships is not passivity. It is control by financial market intermediaries, frequently acting against labour's interests. You might argue that there is an opportunity cost to undertaking workers capital based work, and I'll listen to that point with an open mind. But in return I will argue that there is a risk in inaction.

3. Some union people don't want capital strategies to work at the theoretical level. I think we should just be honest about this. On one level I get this. It would be a lot easier to conclude that we compromise ourselves too much and achieve too little by dirtying our hands undertaking work in financial markets. I would also prefer a system in which labour's voice was significantly stronger than capital's in corporate governance - even if it's workers' capital.

But we aren't starting from where I would like, so I feel a responsibility to look at the reality: point 2 above. Pretty much every week I get an email from a union somewhere in the world along the lines of "we have a problem with employer X, can you help us talk to investor Y?" I feel compelled to try and help them as long as these requests keep coming. I am very happy to discuss why we need a different pension system and/or corporate governance regime, and I often agree with the ideas that people come up with. But that does not help in the short term.

4. I don't believe that undertaking this work reinforces existing governance structures/priorities as some claim. I'm looking at things from a primarily European perspective, but in my experience we are more than capable of both utilising capital strategies within the current framework and trying to change that framework. I also think some Left critics over-estimate how significant policy interventions that unions have taken in some markets are. That said, as I've blogged before, I would not advocate any extension in shareholder rights in the UK, given that a number of institutional shareholders have lobbied against worker voice in corporate governance.

5. It's a tactic, that's all. I don't subscribe to any larger theory about what the existence of workers' pension funds mean in terms of "ownership". Here I agree with critics from the Left. But this does not mean that undertaking work amongst investors cannot be a useful tactic. It's a tool we use to campaign with, and that's enough in my opinion.

Nonetheless at points I think some critics end up articulating a position of "radical inaction" - essentially that it is better not to get involved with pension funds, and we should so other things. I think this would be a mistake, so here are a few points I would make in return.

1. Most obviously, we do not have to choose between organising and capital strategies and other campaigning tactics. Some critics of capital strategies work appear to believe that this is seen as a shortcut to/substitution for organising. I can only speak from my own experience, but most capital strategy work I have been involved in has developed where a) there is a live organising drive and b) where the union(s) at the sharp edge want to engage investors.

This work has to be linked to organising to have any value. In my experience, in practice capital strategies get used where there is live organising and the company responds in a hostile fashion.

2. Almost as obviously, someone will employ capital strategies utilising workers' retirement savings, even if unions don't. Most frequently, our pension funds delegate control to asset managers who will then utilise the power that different corporate law/governance regimes give them to pursue what to them seem to be reasonable objectives. In plenty of companies I've been involved with - Ryanair, Sports Direct etc - there was already some degree of investor interaction with the companies underway before unions got involved.

The default / status quo in terms of use of our capital in shareholder/investor-company relationships is not passivity. It is control by financial market intermediaries, frequently acting against labour's interests. You might argue that there is an opportunity cost to undertaking workers capital based work, and I'll listen to that point with an open mind. But in return I will argue that there is a risk in inaction.

3. Some union people don't want capital strategies to work at the theoretical level. I think we should just be honest about this. On one level I get this. It would be a lot easier to conclude that we compromise ourselves too much and achieve too little by dirtying our hands undertaking work in financial markets. I would also prefer a system in which labour's voice was significantly stronger than capital's in corporate governance - even if it's workers' capital.

But we aren't starting from where I would like, so I feel a responsibility to look at the reality: point 2 above. Pretty much every week I get an email from a union somewhere in the world along the lines of "we have a problem with employer X, can you help us talk to investor Y?" I feel compelled to try and help them as long as these requests keep coming. I am very happy to discuss why we need a different pension system and/or corporate governance regime, and I often agree with the ideas that people come up with. But that does not help in the short term.

4. I don't believe that undertaking this work reinforces existing governance structures/priorities as some claim. I'm looking at things from a primarily European perspective, but in my experience we are more than capable of both utilising capital strategies within the current framework and trying to change that framework. I also think some Left critics over-estimate how significant policy interventions that unions have taken in some markets are. That said, as I've blogged before, I would not advocate any extension in shareholder rights in the UK, given that a number of institutional shareholders have lobbied against worker voice in corporate governance.

5. It's a tactic, that's all. I don't subscribe to any larger theory about what the existence of workers' pension funds mean in terms of "ownership". Here I agree with critics from the Left. But this does not mean that undertaking work amongst investors cannot be a useful tactic. It's a tool we use to campaign with, and that's enough in my opinion.

Wednesday, 20 June 2018

Votes on Persimmon remuneration report

I'm not sure anyone has looked at individual investor voting decisions on the remuneration report at Persimmon's AGM back in April, so I thought I'd take a look. As people may remember, there was a large vote against the rem report, and abstentions and oppose votes were far greater than those for. But on a straight for/oppose split the company "won" roughly 52% to 48% (full results here).

I actually can't find that many disclosed voted as a number of managers disclose by quarter, and we're still in Q2. But of the ones I can find there are some interesting ones.

In the US CalPERS and CalSTRS both opposed.

As did NBIM, the investment arm of the Norwegian sovereign wealth fund

But in the Netherlands ABP/APG and PGGM both abstained

Amongst asset managers I can see that BMO, LGIM and Janus Henderson vote for

Whereas Schroders and Robeco opposed

And Natixis abstained

I'll post up more as I find them.

I actually can't find that many disclosed voted as a number of managers disclose by quarter, and we're still in Q2. But of the ones I can find there are some interesting ones.

In the US CalPERS and CalSTRS both opposed.

As did NBIM, the investment arm of the Norwegian sovereign wealth fund

But in the Netherlands ABP/APG and PGGM both abstained

Amongst asset managers I can see that BMO, LGIM and Janus Henderson vote for

Whereas Schroders and Robeco opposed

I'll post up more as I find them.

Wednesday, 13 June 2018

Chantal Mouffe on centrism and right-wing populism

This is from On The Political, published in 2005:

In a context where the dominant discourse proclaims there is no alternative to the current neo-liberal form of globalisation and that we should accept its dictats, it is not surprising that a growing number of people are listening to those who proclaim that alternatives do exist and that they will give back to the people the power to decide. When democratic politics has lost its capacity to mobilize people around distinct political projects and when it limits itself to securing the necessary conditions for the smooth working of the market, the conditions are ripe for political demagogues to articulate popular frustration.

For some time the case of Britain seemed to provide a counter-example to such an evolution; however the recent success of the [UK] Independence Party in the 2004 European elections suggests that things may be changing. It is of course too early to predict the fate of such a party, and the British electoral system certainly does [not] facilitate the rise third parties. But the dramatic surge in the share of votes needs to be taken seriously. It is undeniable that all the conditions nowadays exist in Britain for a right-wing populist party to exploit the popular frustration.

Unions and public policy

Just a few links to some recent bits and pieces related to rebuilding unions. I am hopeful that the public policy discussion is moving on from simply observing that the decline in union density is correlated with rising inequality (and related issues), to thinking about what we might do to reverse it.

1. Most significant is this IPPR report which has all kinds of ideas about how we can help unions to be a significant force at work again.

2. An interesting economics blog again concluding that stronger unions would be good thing.

3. Stick with me... a piece by Nick Denys from Tory Workers on a Modern Employment Act in this CPS (!) pamphlet. I flag this up to show that there are thinking Tories who do think unions are a good thing (though they obviously don't like the Labour link). There's not a load on offer here, but I think it's interesting that something like this has made it into print.

1. Most significant is this IPPR report which has all kinds of ideas about how we can help unions to be a significant force at work again.

2. An interesting economics blog again concluding that stronger unions would be good thing.

3. Stick with me... a piece by Nick Denys from Tory Workers on a Modern Employment Act in this CPS (!) pamphlet. I flag this up to show that there are thinking Tories who do think unions are a good thing (though they obviously don't like the Labour link). There's not a load on offer here, but I think it's interesting that something like this has made it into print.

Another snippet on Inmarsat takeover and hedge funds

Just to keep this updated, there are a lot of regulatory disclosures being fired out by Inmarsat now. So I'm just keeping track of the hedge fund related ones.

Marshall Wace, which is very active on the short side in the UK, now has a 2.38% long position using derivatives.

Melqart Asset Management, one of the firms that was active around GKN/Melrose, has a 1.17% long position, again using derivatives.

UPDATE: Citadel now has a 1.95% long position, again using derivatives, plus 0.16% short.

Plus Pelham has 1.82% long derivative position I blogged on Monday. So around 7% in long derivative positions held by hedge funds in total so far, just in terms of what we can see (I'm not sure what the disclosure threshold is). I expect this will rise. Presumably these positions are offset by a counter party bank holding actual Inmarsat shares, so we might see them start cropping up on the register as major shareholders as was the case with GKN.

Also worth clocking that some more funds have outstanding short positions in Inmarsat. In addition to the names on the FCA list, regulatory disclosures show that Renaissance Technologies and Millennium Investment Management both have short positions of just under 0.5%.

Marshall Wace, which is very active on the short side in the UK, now has a 2.38% long position using derivatives.

Melqart Asset Management, one of the firms that was active around GKN/Melrose, has a 1.17% long position, again using derivatives.

UPDATE: Citadel now has a 1.95% long position, again using derivatives, plus 0.16% short.

Plus Pelham has 1.82% long derivative position I blogged on Monday. So around 7% in long derivative positions held by hedge funds in total so far, just in terms of what we can see (I'm not sure what the disclosure threshold is). I expect this will rise. Presumably these positions are offset by a counter party bank holding actual Inmarsat shares, so we might see them start cropping up on the register as major shareholders as was the case with GKN.

Also worth clocking that some more funds have outstanding short positions in Inmarsat. In addition to the names on the FCA list, regulatory disclosures show that Renaissance Technologies and Millennium Investment Management both have short positions of just under 0.5%.

Monday, 11 June 2018

Inmarsat: in come the hedge funds

At the back end of last week the UK-listed telecoms business Inmarsat revealed that it has been approached by US-listed Echostar Corporation about a potential takeover, which it knocked back.

As a result of the offer, a different regulatory disclosure regime kicks in, which means that we can see all sorts of detail on which investors are doing what. And, as you might expect, we can already see some hedge funds piling in with fairly sizeable positions.

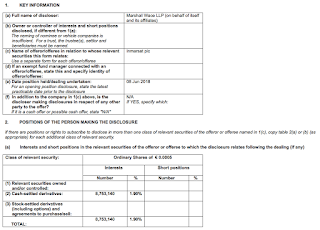

For example, Marshall Wace:

And Pelham:

As you can see from the disclosures, the long positions these funds have taken have been built up using derivatives rather than by buying shares. This shouldn't be any surprise to anyone who followed the detail of the GKN/Melrose bid. And obviously this will be a bloc of investors that will want Inmarsat to be taken over.

It also means that we should expect to see banks emerge as major shareholders on the Inmarsat shareholder register as they build up holdings as counterparts to these derivative positions. Plus we will probably see a notable short position in Echostar emerge.

Finally, here is a quick look at who the major shareholders (1%+) at the moment, data from Capital IQ.

As a result of the offer, a different regulatory disclosure regime kicks in, which means that we can see all sorts of detail on which investors are doing what. And, as you might expect, we can already see some hedge funds piling in with fairly sizeable positions.

For example, Marshall Wace:

And Pelham:

As you can see from the disclosures, the long positions these funds have taken have been built up using derivatives rather than by buying shares. This shouldn't be any surprise to anyone who followed the detail of the GKN/Melrose bid. And obviously this will be a bloc of investors that will want Inmarsat to be taken over.

It also means that we should expect to see banks emerge as major shareholders on the Inmarsat shareholder register as they build up holdings as counterparts to these derivative positions. Plus we will probably see a notable short position in Echostar emerge.

Finally, here is a quick look at who the major shareholders (1%+) at the moment, data from Capital IQ.

UPDATE: for completeness it's worth noting that a few investors are actually short Inmarsat. So worth keeping an eye on this too. Latest from FCA disclosure below.

Sunday, 10 June 2018

Pay ratios - an important step forward

Tomorrow will see the introduction of regulations that will make it mandatory for larger listed companied to disclose the ratio between chief executive salaries and the average pay for employees of the same firm. Although the UK has actually been beaten to this reform by the US of all places, this represents an important development for a number of reasons.

First, it is a shift away from the centrality of shareholder interests. I am unclear about the extent to which Conservative policy wonks are aware of this (or care either way) but if you've followed this debate you should know what I mean.

I don't think many people seriously believe that the disclosure of ratios will lead to the creation of greater returns for shareholders. Nor is the policy aimed at the issue which most shareholders have focused on - tying executive reward to shareholder returns. Rather this policy is all about intra-firm inequality and relative reward. Some shareholders (asset managers) care about these things, many do not. But essentially their support or opposition to the policy is taken to be far less important than would have been the case 5 years ago.

We can see the shift in focus too in the expected revised requirement for demonstrating how the range of stakeholder interests are taken into account by directors. Employees are once again highlighted as an important group. I know for many people on the Left these will seem like very minor tweaks but they do matter.

And that's partly because, secondly, these reforms represent a defeat for the corporate governance mainstream. Most people in the microcosm I inhabit still adhere to the 1990s vintage view of the world, and the policies that flow from it. This is built around disclosure and shareholder empowerment. In that cluster of policies pay ratios make no sense. And it was only a few years ago that major shareholders and their representatives were publicly opposed to pay ratio disclosure. Many still believe the whole exercise is pointless and/or an illegitimate intervention in the shareholder-company relationship. However, some have swung to support ratio disclosure, probably in part because they don't want to be too far out of line with the government, and this isn't a hill worth dying on. Nonetheless it is a defeat for the mainstream and a policy that comes very clearly from the Left is being put in practice by a Conservative government.

Which leads me on to the third reason why this policy is important - it has shifted the centre of gravity in terms of what is "reasonable" to ask for in this area. Again, it wasn't that long ago that arguing for disclosure of pay ratios was very much a left-wing position - and an aspirational one at that. Now that it is being put into practice pay ratios will shortly become the status quo. That means that on the Left we can now use this as a jumping off point for more radical policies. In my opinion we should not underestimate how important and influential having a measure of intra-firm inequality embedded into corporate disclosure will be in terms of shaping people's thinking about a) what matters in this field and b) what might be politically achievable.

It's taken a long time to get here, and there is a lot more to do. For instance we have to push on worker representation in corp gov too - the government lost its nerve, but the door has been left ajar. But the introduction of pay ratios is a win, end of. And it's the start of something.

First, it is a shift away from the centrality of shareholder interests. I am unclear about the extent to which Conservative policy wonks are aware of this (or care either way) but if you've followed this debate you should know what I mean.

I don't think many people seriously believe that the disclosure of ratios will lead to the creation of greater returns for shareholders. Nor is the policy aimed at the issue which most shareholders have focused on - tying executive reward to shareholder returns. Rather this policy is all about intra-firm inequality and relative reward. Some shareholders (asset managers) care about these things, many do not. But essentially their support or opposition to the policy is taken to be far less important than would have been the case 5 years ago.

We can see the shift in focus too in the expected revised requirement for demonstrating how the range of stakeholder interests are taken into account by directors. Employees are once again highlighted as an important group. I know for many people on the Left these will seem like very minor tweaks but they do matter.

And that's partly because, secondly, these reforms represent a defeat for the corporate governance mainstream. Most people in the microcosm I inhabit still adhere to the 1990s vintage view of the world, and the policies that flow from it. This is built around disclosure and shareholder empowerment. In that cluster of policies pay ratios make no sense. And it was only a few years ago that major shareholders and their representatives were publicly opposed to pay ratio disclosure. Many still believe the whole exercise is pointless and/or an illegitimate intervention in the shareholder-company relationship. However, some have swung to support ratio disclosure, probably in part because they don't want to be too far out of line with the government, and this isn't a hill worth dying on. Nonetheless it is a defeat for the mainstream and a policy that comes very clearly from the Left is being put in practice by a Conservative government.

Which leads me on to the third reason why this policy is important - it has shifted the centre of gravity in terms of what is "reasonable" to ask for in this area. Again, it wasn't that long ago that arguing for disclosure of pay ratios was very much a left-wing position - and an aspirational one at that. Now that it is being put into practice pay ratios will shortly become the status quo. That means that on the Left we can now use this as a jumping off point for more radical policies. In my opinion we should not underestimate how important and influential having a measure of intra-firm inequality embedded into corporate disclosure will be in terms of shaping people's thinking about a) what matters in this field and b) what might be politically achievable.

It's taken a long time to get here, and there is a lot more to do. For instance we have to push on worker representation in corp gov too - the government lost its nerve, but the door has been left ajar. But the introduction of pay ratios is a win, end of. And it's the start of something.

Sunday, 3 June 2018

Keep your nose out of executive pay!

This is from the concluding paragraph of a recent academic paper on executive pay:

But the above paragraph is indicative of why I have a lot of problems with some of the dominant ideas in corporate governance, and in the sub sector of executive pay.

Given that we know that in Actually Existing Capitalism when we say "shareholders" we really mean asset managers. (As a side note in this paper it is notable that union pension funds are highlighted as a group of activists, with the implication (as I read it) that they aren't really the right kind of shareholders.) As such I really struggle with the suggestion that union members and workers (they have to be prefaced with the pejorative 'disgruntled', obviously) are "uninvited guests" in discussions about the distribution of rewards within companies. And I think upside-down to suggest that the workers in a company have no real stake in the business compared to shareholders.

This conclusion also takes as read that creating wealth for shareholders is the function of business (rather than, say, one of its outcomes) which is highly contestable. More interestingly, again we see a mainstream corporate governance paper suggesting that different stakeholder interests - those of union members and other workers, and those of shareholders - are potentially in conflict. The implication in this paper is that in such a scenario the interests of shareholders are justified and therefore should win out. I would say these are far from settled issues now.

What about the claim that critics are substantially driven by "jealousy and envy"? I would suggest that it's more about conceptions of fairness, which seems to be form of judgement that humans have evolved. I think that people are more concerned that rewards are determined fairly, than that they necessarily benefit personally. The sense you get from ordinary punters is less "I want some of that" than "how the hell do they get away with this?". But if jealousy/envy is apparently so important, shouldn't we expect to see this in the demands made by executives in respect of their remuneration, and perhaps we should start there?

Finally, in my opinion the tone of the paper, exemplified by the conclusion, is part of the problem that the 1990s corporate governance model has. In this world, executive pay is not a political issue, it is a technocratic one that, if it cannot be 'solved', can at least be defused. There is an array of views that are packaged into this perspective, such as that pay is a private matter between companies and shareholders; the public is misinformed/misled; politicians are meddlers who usually make mistakes; and concern about pay levels (rather than structure) is misplaced. As such it is quite a natural for people who hold these views to suggest that only a select group of people are legitimately allowed to comment about executive pay. Personally I am surprised otherwise smart people cannot grasp how utterly elitist all this sounds.

While the pay controversies fueling calls for regulation have touched on legitimate issues concerning executive compensation, the most vocal critics of CEO pay (such as members of labor unions, disgruntled workers and politicians) have been uninvited guests to the table who have had no real stake in the companies being managed and no real interest in creating wealth for company shareholders. Indeed, a substantial force motivating such uninvited critics is one of the least attractive aspects of human beings: jealousy and envy.I would recommend giving the paper a read as it has some interesting things to say about various attempts at executive pay reform. Two things in particular I did appreciate are the acknowledgement of the potential for *positive* unintended consequences from policy interventions, and of the fact that companies do try and find gaps in / ways around regulation.

But the above paragraph is indicative of why I have a lot of problems with some of the dominant ideas in corporate governance, and in the sub sector of executive pay.

Given that we know that in Actually Existing Capitalism when we say "shareholders" we really mean asset managers. (As a side note in this paper it is notable that union pension funds are highlighted as a group of activists, with the implication (as I read it) that they aren't really the right kind of shareholders.) As such I really struggle with the suggestion that union members and workers (they have to be prefaced with the pejorative 'disgruntled', obviously) are "uninvited guests" in discussions about the distribution of rewards within companies. And I think upside-down to suggest that the workers in a company have no real stake in the business compared to shareholders.

This conclusion also takes as read that creating wealth for shareholders is the function of business (rather than, say, one of its outcomes) which is highly contestable. More interestingly, again we see a mainstream corporate governance paper suggesting that different stakeholder interests - those of union members and other workers, and those of shareholders - are potentially in conflict. The implication in this paper is that in such a scenario the interests of shareholders are justified and therefore should win out. I would say these are far from settled issues now.

What about the claim that critics are substantially driven by "jealousy and envy"? I would suggest that it's more about conceptions of fairness, which seems to be form of judgement that humans have evolved. I think that people are more concerned that rewards are determined fairly, than that they necessarily benefit personally. The sense you get from ordinary punters is less "I want some of that" than "how the hell do they get away with this?". But if jealousy/envy is apparently so important, shouldn't we expect to see this in the demands made by executives in respect of their remuneration, and perhaps we should start there?

Finally, in my opinion the tone of the paper, exemplified by the conclusion, is part of the problem that the 1990s corporate governance model has. In this world, executive pay is not a political issue, it is a technocratic one that, if it cannot be 'solved', can at least be defused. There is an array of views that are packaged into this perspective, such as that pay is a private matter between companies and shareholders; the public is misinformed/misled; politicians are meddlers who usually make mistakes; and concern about pay levels (rather than structure) is misplaced. As such it is quite a natural for people who hold these views to suggest that only a select group of people are legitimately allowed to comment about executive pay. Personally I am surprised otherwise smart people cannot grasp how utterly elitist all this sounds.

Subscribe to:

Posts (Atom)