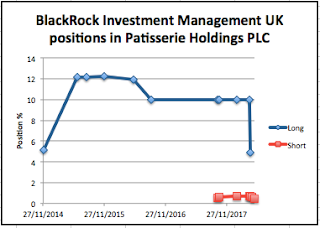

Just a bit of Excel fun on a Sunday lunchtime. In its relatively short life as a public company, Patisserie Holdings didn't issue that many market announcements, so it's easy to pull together TR1 notices. I know that BlackRock had a big long position that it cut right back last April. The TR1 notices it triggered show that the holding was attributed to BlackRock Investment Management (UK).

In addition the only notifiable (0.5%+) short in Patisserie Holdings history on the public market was also tagged to BlackRock Investment Management (UK). It appeared in late 2017 and dipped back down below the disclosure threshold in mid May 2018.

So I just stuck the two together in the chart below. NB - I've only recorded what I know, obviously there could have been more shorting below 0.5%. And the last position on the long side is 4.9%, as all I know is that they went under 5% (it could have gone to zero).

The position disclosed in the TR1s doesn't actually match the disclosure in Patisserie Holdings' 2017 Annual Report & Accounts:

It's possible that the annual report listed the position net of lending, and that BlackRock had lent out a couple of percent or so. But I'm just guessing.

Just another small thing I noticed. BlackRock discloses that it voted at the company's EGM in November last year, as it appears in the iShares voting record, with 3 ETFs holding it at least. One of these disclosures is below. However nothing turns up for Patisserie Holdings via its US mutual fund disclosures.

Because BlackRock doesn't leave historical votes online in a searchable format (sigh.....) I had to look on the SEC site to try to find out how it voted at the January AGM. But there is no disclosure for that meeting (which fell into the prior year's reporting period for the NPX form), so I'm guessing that the same ETFs did not hold the stock at that point.

So I'm a bit stumped as to how I can find how it voted at the January 2018 AGM. I assume that it voted for everything since, even it only voted the 7.2% disclosed in the annual report a vote against or abstention of 7m+ shares would have shown up in the results (as total issued shares stood at a helpfully round 100m). And there's nothing like that in the results.

Final point on those AGM results. The turnout was a paltry 29%, or 29m shares, at the 2018 AGM, down from 66.2% (66m shares) at the 2017 AGM. Luke Johnson's holding was 38.6% according to the annual report, or 38m shares. So at the least he didn't vote all his holding in 2018. And 29 + 38 gets you to 67%.

No comments:

Post a Comment